What’s the difference?

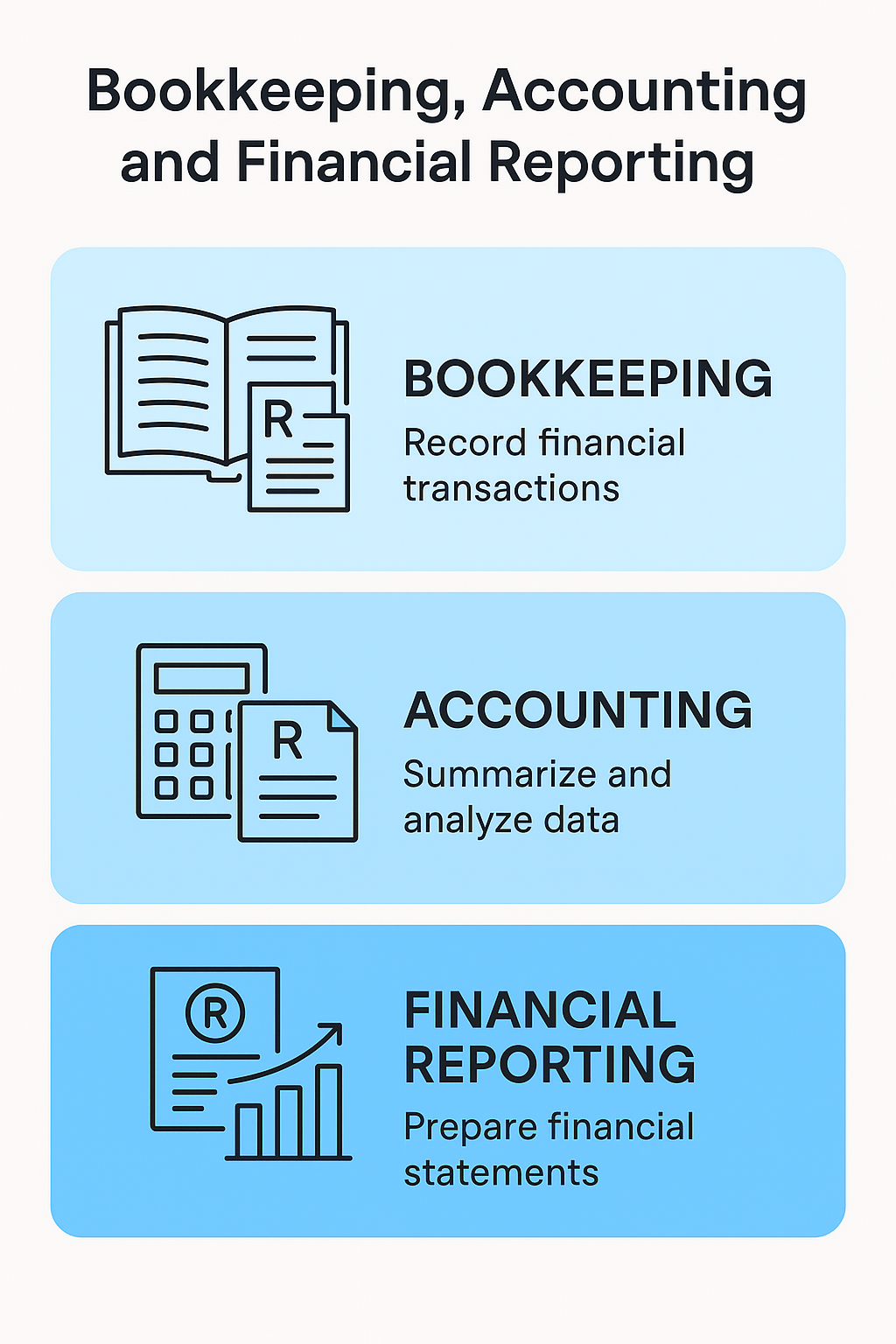

Understanding the distinctions between bookkeeping, accounting, and financial reporting is fundamental for effective financial management in a small business. While these terms are closely related and often overlap, they represent different levels and types of financial activity within a business.

In summary, bookkeeping is the diligent, day-to-day recording of every financial transaction. Accounting is the broader system that takes these raw bookkeeping entries, organizes them, and uses them to prepare formal financial statements (the output of accounting). These financial statements, which are a form of financial reporting, then provide a comprehensive summary of the business’s financial health for analysis, decision-making, and compliance.

Here is more detail on each of these terms …

Here’s a breakdown of each

- Bookkeeping

- Definition: Bookkeeping is the day-to-day administration involved in keeping your small business’s finances in optimal shape. It is the systematic recording of financial transactions. Every business, regardless of size, needs to record its transactions regularly and systematically, as this is the basis for legal compliance.

- Tasks: This includes generating and sending invoices, recording expenses, monitoring outgoings, and paying employees. It ensures every transaction is accounted for.

- Purpose: Bookkeeping forms the foundation upon which a business’s financial accounts are built. It helps track income and expenses and ensures accuracy for tax submissions and VAT payments/reclaims. It helps you assess the financial health of your business, even if it’s not immediately obvious from your bank account.

- Tools: Bookkeeping can be done manually, such as by simply recording daily expenditure and income in columns, or more efficiently using cloud accounting software.

- Accounting

- Definition: Accounting is defined as the systematic and comprehensive recording of financial transactions pertaining to a business. It is considered “the language of business”. The accounting function involves collecting, organizing, and presenting financial information in a systematic fashion.

- Objective: The primary objective of financial accounting is the preparation of financial statements. It also provides the information necessary for tax returns and reports for managers.

- Scope: Accounting encompasses bookkeeping; the day-to-day bookkeeping tasks feed into the larger accounting system. It’s crucial for keeping your business safe and compliant with tax authorities.

- Skills: While accounting is about the precise reporting of financial position, a business owner doesn’t necessarily need to be an accountant; they may interpret financial statements even if they can’t prepare them. Accounting skills have been shown to have a positive effect on SMEs’ financial sustainability, helping owners make informed judgments and boost financial efficiency.

- Financial Reporting (or Financial Statements)

- Definition: Financial reporting involves the periodic financial statements that summarise a company’s financial position and performance. These documents provide critical insights into a small business’s financial performance and position.

- Key Documents: The main financial planning and forecasting documents that every small business owner should produce and regularly maintain include:

- Balance Sheet: This provides a snapshot of your business’s financial standing at a specific point in time. It lists what the business owns (assets), what it owes (liabilities), and the amount owners have invested (equity), which can be used to calculate the net worth.

- Profit and Loss Statement (also called Income Statement): This summarises the business’s revenues and expenses over a period (typically a year) to calculate the net profit or loss. It helps measure profitability over time and determine the breakeven point.

- Cash Flow Statement: This reflects the inflow and outflow of cash from your business activities over a specified period (e.g., a month or quarter). It is vital for ensuring there is enough cash to operate day-to-day and helps anticipate financial shortfalls.

- Revenue Forecast: An educated prediction of how much money your company is likely to bring in over the upcoming year, helping you estimate what you can afford to spend and your potential profit margin.

- Purpose: These reports are used for internal tracking of revenue, expenses, and profitability, for filing business taxes, for applying for business financing, for performance evaluation, and for building confidence with investors and lenders. They also ensure compliance with regulatory requirements.