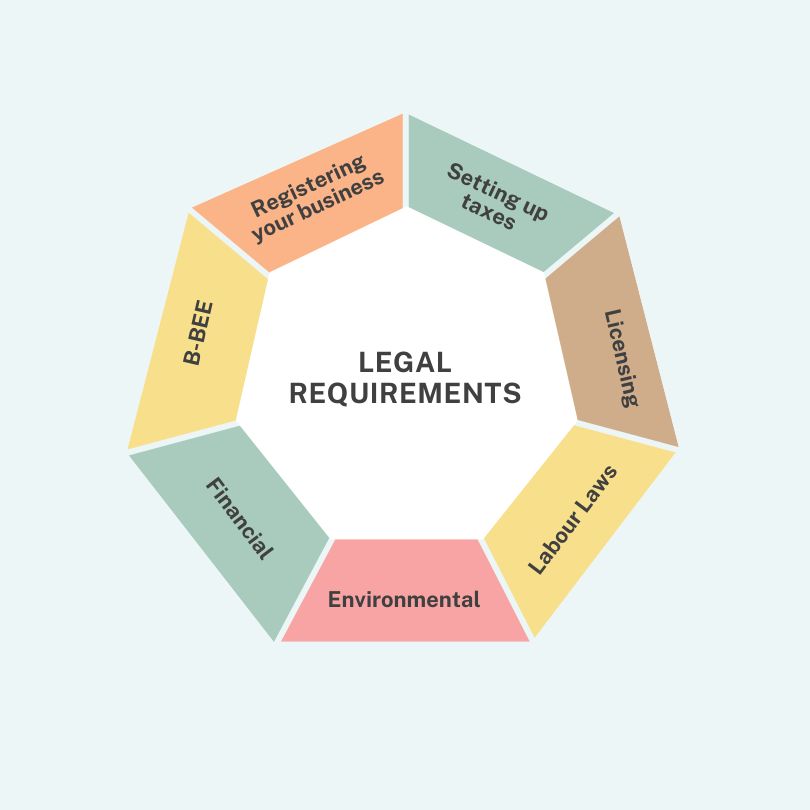

Starting a business is an exciting journey, but it’s essential to get the legal side of things right from the very beginning. South Africa has a range of legal requirements for businesses, and these rules depend on your business structure, size, and industry. While it may feel like a lot of admin at first, ensuring your business complies with the law will save you stress and potential fines down the road. Complying with South Africa’s legal requirements isn’t just about avoiding penalties—it’s about building a solid foundation for your business. A compliant business is more attractive to investors, partners, and customers. It also gives you peace of mind to focus on growing your business instead of worrying about potential legal issues.

Decide on a business structure

The first step in formalizing your business is deciding on a business structure. In South Africa, you can choose from the following:

- Sole Proprietorship: For individuals running their own business, like a freelance photographer or a spaza shop owner.

- Partnership: For businesses owned and run by two or more people, such as a law firm or bakery co-owned by friends.

- Proprietary Limited Company (Pty Ltd): A common choice for entrepreneurs aiming to limit their personal liability.

If you’re not operating as a sole proprietor, you’ll need to register your business with the Companies and Intellectual Property Commission (CIPC). This process ensures your business has a legal identity, which is important for opening a bank account, signing contracts, and protecting your business name. For instance, if you’re starting “Jozi Eats Catering (Pty) Ltd,” registering with the CIPC secures the name and makes your business official.

Setting Up Taxes

Paying taxes is a non-negotiable part of running a business in South Africa. The type of taxes you need to register for depends on your business structure and income. If you’re just starting out and need to register your business as a company, you’ll need to contact the Companies and Intellectual Property Commission (CIPC)—which was previously known as CIPRO. Keep in mind that you have to register your company with CIPC first, before moving on to register with SARS for an Income Tax reference number.

Once you’ve registered your company with CIPC, SARS will automatically issue an Income Tax reference number for your business. After that, you’ll need to sign up on eFiling, which is SARS’s online platform, so you can handle your tax matters electronically. It’s a straightforward process that helps you manage your taxes efficiently and keep everything compliant.

If you’re ready to start the process, visit the CIPC website for more information and to begin your registration.

First, every business must have a tax reference number, which you can get from the South African Revenue Service (SARS). Sole proprietors and partnerships register as provisional taxpayers, while companies are automatically registered when they’re set up through the CIPC.

If your business earns over R1 million annually, you must register for Value-Added Tax (VAT). For example, a small furniture manufacturing company that exceeds this threshold will need to collect and remit VAT on its sales. Additionally, if you employ staff, you’ll need to register for PAYE (Pay As You Earn) and contribute to the Unemployment Insurance Fund (UIF).

Working with a tax consultant can help you structure your business in the most tax-efficient way while ensuring you meet SARS requirements.

Obtaining the Right Licenses

Depending on your business type, specific licenses and permits may be required. For example:

- If you’re opening a restaurant, you’ll need a certificate of acceptability from your local health department.

- A manufacturing business may require zoning approval and an environmental impact assessment.

Licensing requirements often depend on your location. For instance, if you’re starting a food truck in Cape Town, you’ll need to comply with the city’s specific by-laws for mobile food vendors. Always check with your local municipality to ensure you have all the necessary permits to operate legally.

Complying with Labour Laws

If you plan to hire employees, compliance with South Africa’s labour laws is crucial. This includes adhering to minimum wage regulations, ensuring fair working hours, and providing leave entitlements.

For example, if you hire staff for your cleaning service, each employee must have a clear employment contract outlining their roles, responsibilities, and benefits. Make sure these contracts comply with the Basic Conditions of Employment Act (BCEA).

Additionally, you’ll need to register with the Department of Labour for the Compensation for Occupational Injuries and Diseases Act (COIDA). This provides coverage for employees injured on the job.

Meeting Environmental and Zoning Requirements

Your business premises must comply with local zoning regulations. For example, you can’t set up a noisy car repair shop in a residential area. Similarly, a manufacturing business must adhere to environmental laws regarding waste management and pollution.

If you’re starting a small-scale organic farming business, for instance, you may need approval to ensure your practices align with environmental guidelines. Contact your local municipality to understand the specific requirements for your business location and industry.

Maintaining Financial Records

Keeping accurate financial records is essential for tax compliance and running a smooth operation. Every business must track revenue, expenses, and transactions.For example, if you’re running a second-hand clothing store, separate your personal and business finances by opening a dedicated business bank account. This makes it easier to manage bookkeeping, file taxes, and apply for loans or grants in the future.

Regularly updating your financial records also helps you monitor cash flow and identify opportunities for growth. Consider investing in bookkeeping software or working with an accountant to stay organized.

B-BEE certification

Understanding B-BBEE and Why It Matters for Your Small Business

If you’re running or planning to start a small business in South Africa, you’ve likely heard of Broad-Based Black Economic Empowerment (B-BBEE). But what exactly is it, and why is it important for your business?

B-BBEE is a government policy aimed at addressing the inequalities of South Africa’s past by encouraging the inclusion of historically disadvantaged groups—particularly black South Africans—into the economy. The idea is to create a more equitable and diverse business environment while empowering individuals and communities that were previously excluded from economic opportunities.

For small businesses, complying with B-BBEE isn’t just about ticking a box—it can open up a world of opportunities. Many larger companies, especially those in sectors like construction, retail, and logistics, are required to work with B-BBEE-compliant suppliers to improve their own B-BBEE scores. By meeting the requirements, your business becomes more attractive to these companies, giving you a better chance of securing contracts, partnerships, or funding.