When you run a small business, you need to know if you’re heading in the right direction. That’s where Key Performance Indicators (KPIs) come in. They help you measure how well your business is doing in areas like sales, customer service, operations, and finances. KPIs are not just for big corporates. Whether you’re a small-scale farmer in Limpopo, a digital creator in Jozi, or a home-based caterer in East London, KPIs help you work smarter, stay focused, and grow confidently.

Tracking the right numbers makes your business journey clearer — and your next big win more achievable.

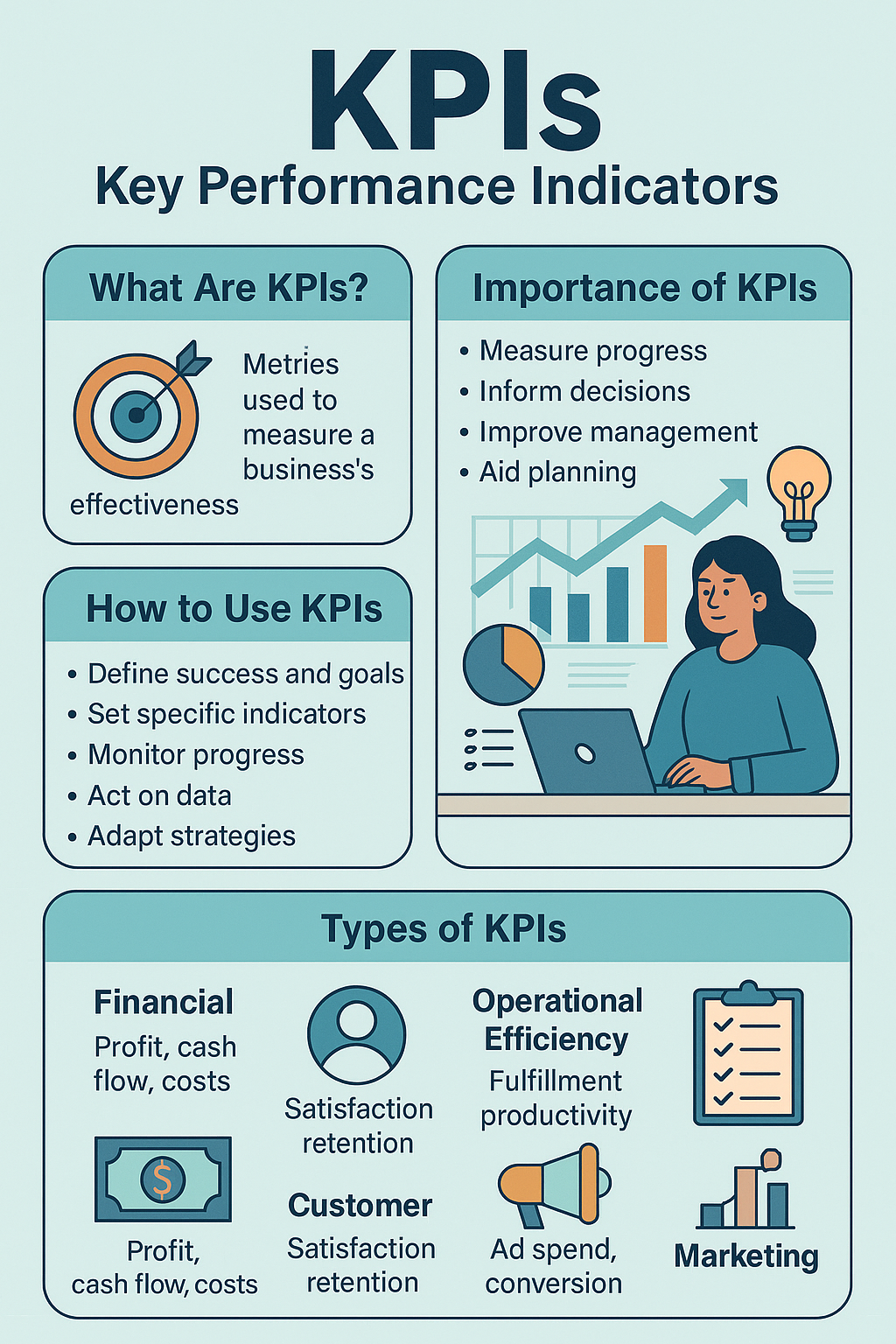

What Are KPIs?

KPIs are numbers that tell you how your business is performing. Think of them like the dashboard in your car — they show you whether you’re speeding up, slowing down, or need to stop and fix something. KPIs go beyond just profits. They include things like:

- How happy your customers are

- How fast you’re delivering products

- How many people are visiting your website

- How much it costs to make and sell your products

Why KPIs Matter for Small Businesses

Tracking your KPIs isn’t just about data — it helps you stay in control and grow. Here’s why they’re so important:

- Measure Progress: KPIs help you check if you’re reaching your business goals — like increasing monthly sales in your coffee shop in Johannesburg or growing your Instagram following for your handmade jewellery brand.

- Make Smart Decisions: When you see the numbers clearly, you can make better decisions — like knowing when to order more stock or where to spend your marketing budget.

- Manage Staff and Productivity: Keeping track of staff output in your car wash, salon, or construction team can help improve how everyone works together.

- Build a Loyal Team: Sharing simple KPIs with employees (like daily sales or customer reviews) keeps everyone involved and motivated.

- Stay Financially Healthy: Profit doesn’t always mean cash in the bank. KPIs help you understand if your business is really making money or just surviving month to month.

- Access to Funding: If you ever want a loan from a South African bank or funders like the NYDA, they’ll look at your KPIs (especially financial ones) to decide if your business is trustworthy.

- Plan for the Future: Whether you want to open another store or expand your delivery zone, KPIs help you know when and how to grow.

Types of KPIs to Track

Here are four main categories of KPIs you should know:

3. Operational Efficiency KPIs

📊 Free Google Sheets KPI Templates

- Smartsheet KPI Dashboard Template: A ready-to-go Google Sheets dashboard for tracking key metrics like revenue, expenses, and margins with charts and graphs (smartsheet.com).

- Template.net KPI Sheets: Professionally designed, editable KPI and dashboard templates to plug into Google Sheets (template.net).

- Andy Young’s Weekly/Monthly KPI Template: A structured Google Sheets doc for monitoring week-on-week or month-on-month changes (docs.google.com).

- HubSpot & Datapad template collections: Offer diverse business templates including KPI trackers and dashboards (datapad.io).

👉 How to start: Select a template from the Google Sheets Template Gallery, or upload one of the above into your Drive and customize the KPI headings to match your business needs.

🇿🇦 South African SME Tools

1. Xero ZA

- Cloud accounting software with built-in KPI tracking dashboards (e.g., cash flow, sales, profit margin) (polymersearch.com, xero.com).

- Ideal for small SA businesses, with real-time performance charts and simple visualization tools.

2. HRSimplified

- An all-in-one HR platform built for South African SMEs — tracks KPIs related to employee performance, recruitment metrics, and compliance (leave, payroll, performance reviews) (hrsimplified.org).

3. Basic Spreadsheet + Accounting Templates

- Many SA SMEs track finance KPIs using free spreadsheet templates or basic accounting software like Sage, Xero Lite, or QuickBooks (thrivecfo.co.za).

4. Google Analytics (Free)

- Essential for monitoring website and marketing KPIs like visitors, click-through rates, and conversion metrics .

5. Business Intelligence Tools

- Visual KPI, Zoho Analytics, or Power BI integrate data across operations and finance to deliver live dashboards (capterra.co.za).

🛠️ How to Set Up Your KPI Toolkit

| Step | Tool/Template | Purpose |

|---|---|---|

| 1 | Google Sheets dashboard | Easy, free, and highly customizable for financial, operational KPIs |

| 2 | Xero | Automates financial reporting with real-time insight |

| 3 | Google Analytics | Tracks online engagement and marketing effectiveness |

| 4 | HRSimplified | Manage HR metrics and performance where staff is involved |

| 5 | Visual KPI / Zoho Analytics | Optional step for live, multi-source data visualization |

✅ Recommended Setup for South African SMEs

- Start with a Google Sheets KPI dashboard, leveraging free templates.

- Connect your accounting system (Xero, Sage) for automatic data feeding.

- Integrate Google Analytics to cover marketing KPIs.

- Consider HRSimplified if you manage multiple staff and want to track performance.

- Scale up later with BI tools like Visual KPI or Zoho Analytics as your business matures.